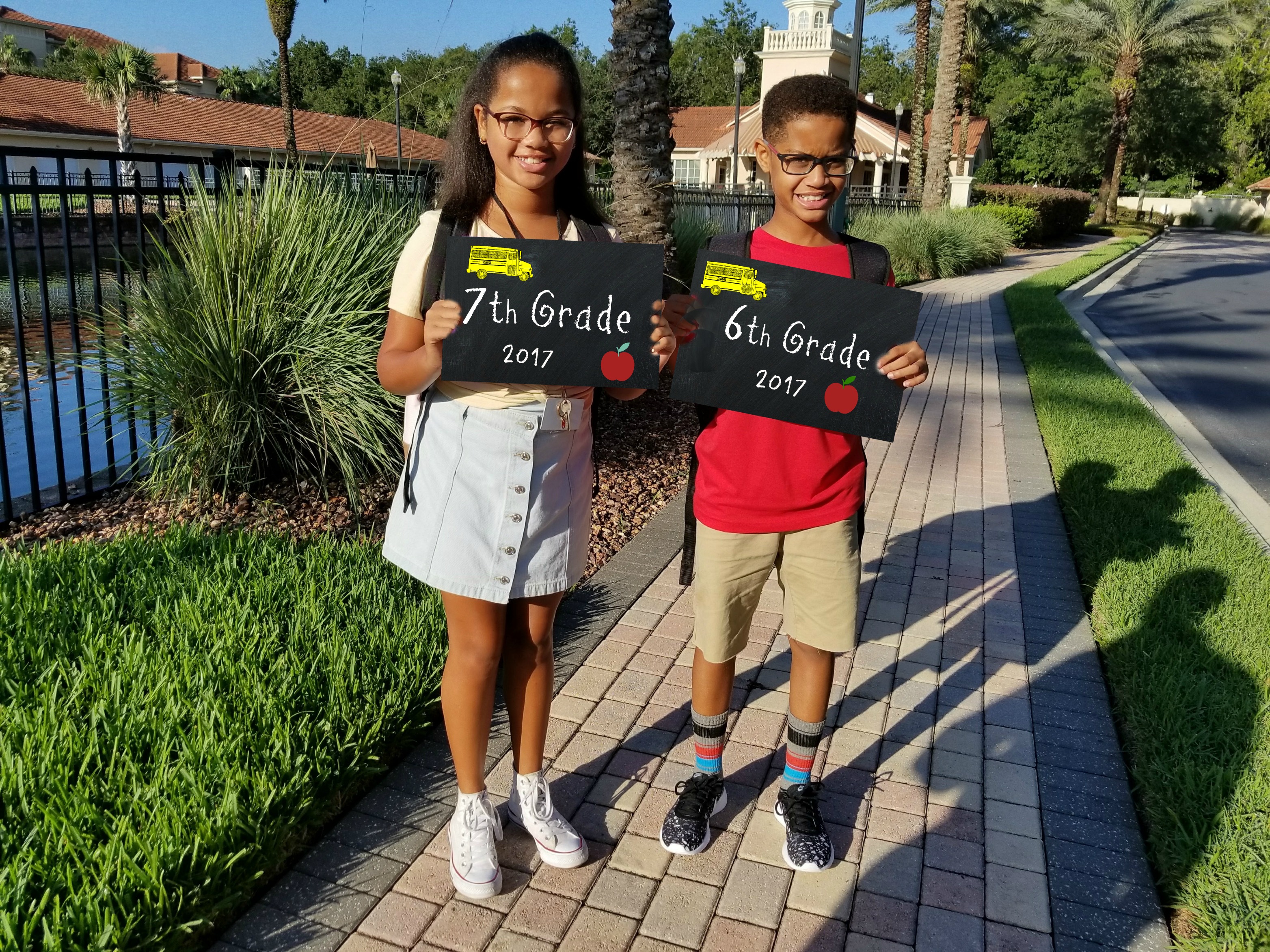

I wish I could say we started saving for college when each of our children were born. When my first son was born, we were young parents, I was still in law school, and my former husband was the only one working. At that time, we lived in Washington D.C. I graduated from school then before we knew it, we moved to Florida. Then babies two and three were born. We were making good money as I was now practicing law but by the time our third was born, I realized a career as a litigator was not entirely conducive or easy as a mom to three kids ages four and under. So I resigned from my law firm and took a less paying job as a law professor. Time flew by and soon we were in a financial place where it was time to start thinking about our future and that of our children. A retirement plan and a college savings plan for the kids was our first two priorities.

As I wrote before, my parents were not in a position to save for my college when I was growing up. We immigrated into this country when I was just a toddler and it took about ten years before we were really on our feet. My parents had planned on setting aside the money but they just never did. Before my parents knew it, my older brother was applying to colleges and I was behind him by four years. Off my older brother went then it was my turn. I had saved some money from summer jobs and graduation gifts but by the time college started, I was filling out financial aid forms and praying I had enough in scholarships to offset the cost of school, room and board, and living expenses.

I picked an out-of-state school which meant the scholarships I did get were not even close to paying for out-of-state tuition. Seven years later, I had two degrees, a B.A. and a law degree, and mountain of student loan debt.

It was not a good feeling.

Fast forward to me as a parent of three kids. I understood better the importance of planning ahead to save money for college and that even setting aside $50 a month would make a big difference for my children. We met with a financial planner who told us what our options were for saving for college and we did our own research. A prepaid college savings plan was going to help us understand just how much we needed to save, make sure we stayed on target to save that much, and gave us a manageable monthly payment for us to set aside and invest in our children’s future.

I had never even heard of prepaid plans before we spoke to someone from The Florida Prepaid College savings plan. I didn’t know what prepaid plans were or how it worked. I knew that most states had their own prepaid plan and assumed that the state we chose to invest in would be the only option for our kids. I was worried about that because I wanted my children to be able to select the best college for them and it may or may not be in Florida.

I learned a lot about the process and how prepaid plans worked. Like many parents, I had some misconceptions about the program. These misconceptions sometimes prevents parents from signing up! These common misunderstandings, outlined below, may also be preventing you from taking the first step in securing your child’s future of going to college.

Top Three Misconceptions about College Prepaid Plans

- Myth: Florida Prepaid is restricted to Florida schools. Fact: It isn’t restricted to Florida schools; the amount covered by your Prepaid Plan can be used at both public and private schools nationwide.

- Myth: Florida Prepaid can only be used if my child remains a Florida resident. Fact: If the beneficiary moves out of Florida after purchasing a Prepaid Plan, your child would still be billed at in-state tuition rates when using their plan at a Florida college or state university.

- Myth: If my child doesn’t go to college, I lose all that money. Fact: If your child doesn’t go to college, you can change the beneficiary of the Prepaid Plan or get your money back.

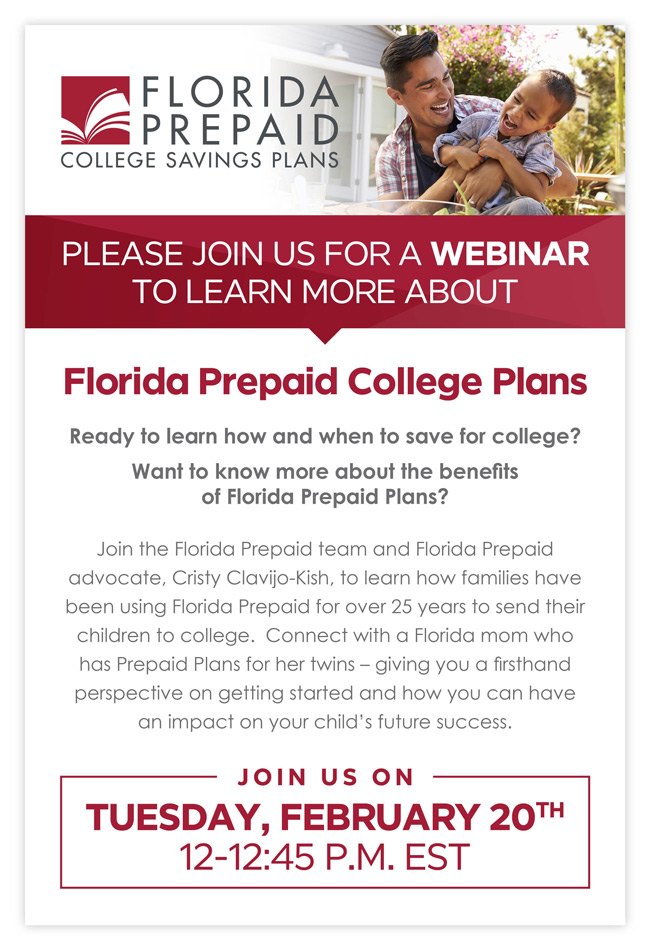

Enrolling in Florida Prepaid made sense for my husband and I. If you want to learn more you can do two things. You can check out the FAQ’s on the Florida Prepaid website: http://www.myfloridaprepaid.com/faqs. You can also learn more about Florida Prepaid by attending a FREE webinar for parents who have questions or want to learn more about Florida Prepaid. Register today for the Florida Prepaid Webinar: The Importance of Saving for College Now. The Webinar takes place February 20, 2018 from 12-12:45 P.M EST.

Don’t wait another year to start saving for college. When you’re ready to begin the process, use my special Florida Prepaid coupon code, JUST1718, to get %50 off the application fee during open enrollment. Open enrollment ends February 28, 2018!

Thank you to Florida Prepaid College Board for sponsoring today’s blog post and inviting me to participate in the Believer Blogger program.

Leave a Reply