In just three years, my oldest son will be heading to college. While the immediacy of that huge milestone has only recently sunk in, thankfully saving for his college tuition is something we started years ago. Like most parents, you may need help deciding how to pay for your child’s college tuition. You may be wondering if a prepaid plan like Florida Prepaid is the right option for you. Avoid the cost of waiting and start saving for your child’s college tuition now. Below, I’m sharing everything you need to know about getting started with Florida Prepaid savings plans and how you can enter to win one of 10 Florida Prepaid college scholarships.

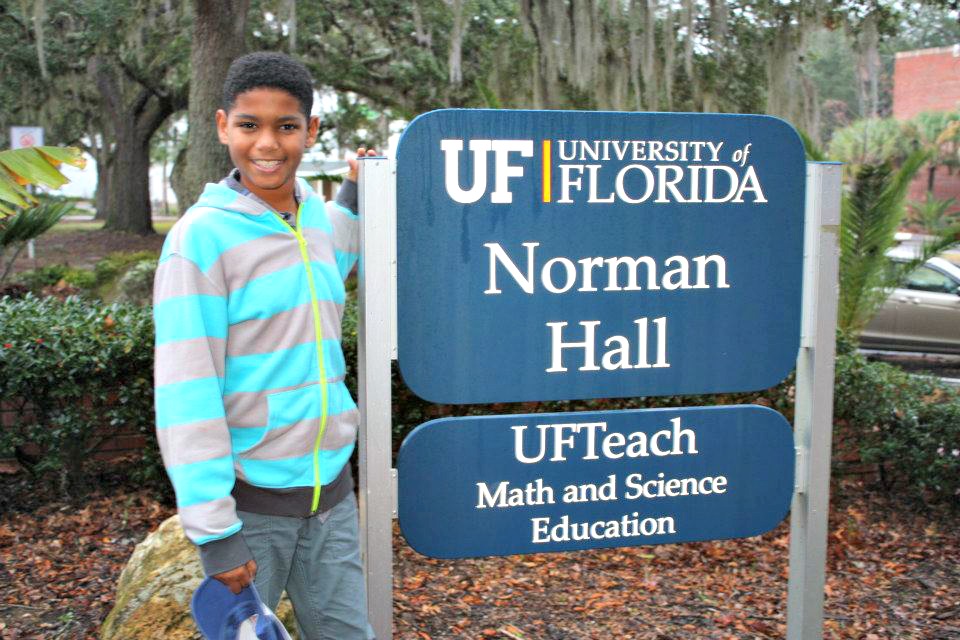

It seems like yesterday, I was a young, new mom still processing that I was responsible for the tiny human laying in my arms. In what seems like a blink of an eye, he’s now sixteen and I will soon be wiping tears away as we send him off to college and remembering how we were just walking him into his first day of kindergarten.

I graduated from college with a lot of student loan debt that I’m currently still paying even twenty years later. My former husband on the other hand, crossed the stage entirely debt free. We both wanted our children to graduate college without any student loans and we wanted to do our part to make that happen. But we were like many parents wondering how we could save for college tuition. Thankfully, we learned about programs like Florida Prepaid that exists to help parents (and grandparents or other relatives who want to contribute) to plan ahead and save for college.

What is Florida Prepaid?

Florida Prepaid College Plans allow families to pay for the future cost of college in advance. Parents have two options through Florida Prepaid. There is the Florida Prepaid College Plan and the investment plan known as the 529 College Savings Plan. The plans are meant to be used at a Florida College or State University, however, if your child chooses to go to school in another state, the amount covered by the plan can be applied to other schools nationwide. Families can enroll in both a 529 plan and prepaid plan.

What is the difference between Florida Prepaid College Plan and the 529 Savings Plan?

The difference between both plans is that with the Florida Prepaid College Plan, parents select options with specific costs, payment schedules, and benefits. The Florida 529 Savings Plan, on the other hand, is an investment plan similar to a 401k plan you may have at work. With the 529 Savings Plan, parents choose from several investment options and decide how much and how often they want to contribute. Like your 401k, the Florida 529 Savings Plan is subject to fluctuations in the financial markets. The Florida Prepaid College Plan is guaranteed by the State of Florida.

When should parents start saving for college?

The sooner, the better. Through Florida Prepaid, you pay for future tuition and fees at the current price of the plan that you select. Florida Prepaid Open Enrollment begins October 15th and ends February 28. Parents can enroll in the 529 Savings Plan any time of the year and at any age before college starts. However, enrollment for Florida Prepaid must take place before your child enters the 11th grade.

Why enroll In Florida Prepaid?

To lock in current tuition rates. College tuition prices increase every year. According to Florida Prepaid College Board, since 1985 the cost of college has increased 538% – more than medical cost (236%) or gasoline (200%). Enroll in Florida Prepaid now and you’ll lock in current rates.

How much should Parents save for college?

How much should you put away each month to save for your 5-year-old to attend a Florida University? A number of factors should be considered such as whether your child attends a private or state college and how long before college begins. Thankfully, Florida Prepaid helps takes the guesswork out of how much you should save through its College Savings Planner. The online tool allows parents to take a closer look at how to pay for college and takes into account factors like your child’s age at the time of savings and total projected education costs. It then estimates the monthly savings needed to meet your goals.

What happens to Florida Prepaid if your child receives a scholarship to attend college?

Congratulate yourself on raising a talented student! Then, for the Florida Prepaid plan, request a refund for the same amount as the plan would pay a public college or university in Florida. If you invested in the 529 Savings Plan, the amount invested can be used to make up any difference in qualified higher-education expenses not covered by the scholarship.

Win a college Scholarship!

Don’t wait to start saving for college. If you’re just getting started or want to learn more about your college savings options, visit the Florida Prepaid College Board website loaded with useful information and tools for families. While you are there, be sure to register for your chance to win one of 10 Florida Prepaid Foundation Scholarships awarding lucky Florida families the opportunity to win a 2-Year Florida College Plan. Use Promo Code: BLOG1718 to win more entries!

This post is sponsored by the Florida Prepaid College Board, through my role as a Believer Blogger. All thoughts are my own.

Leave a Reply